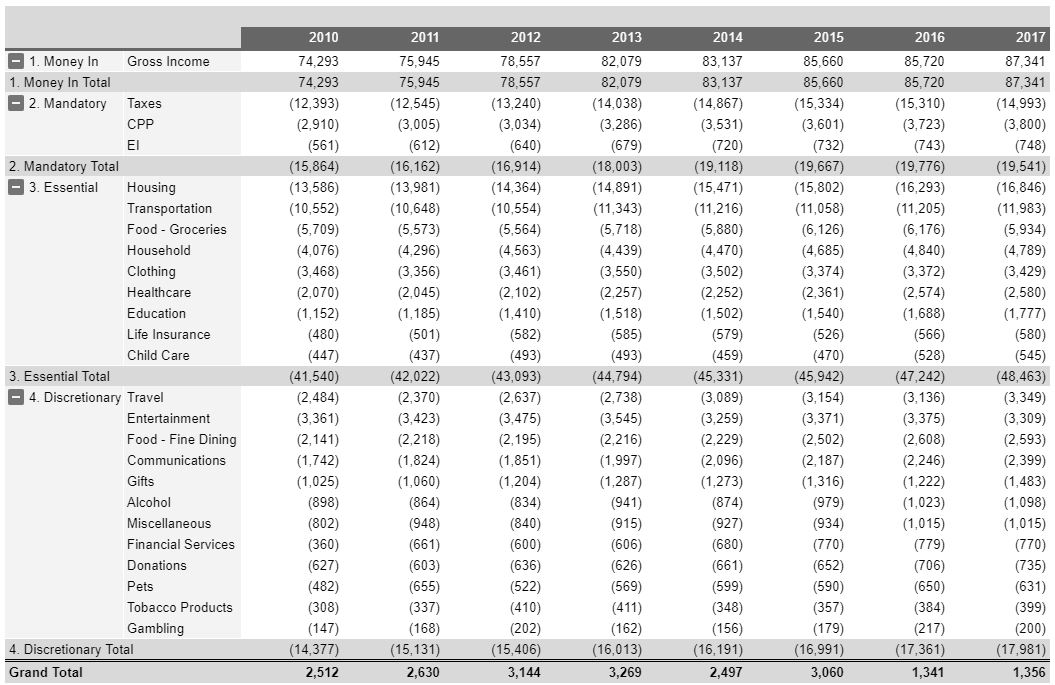

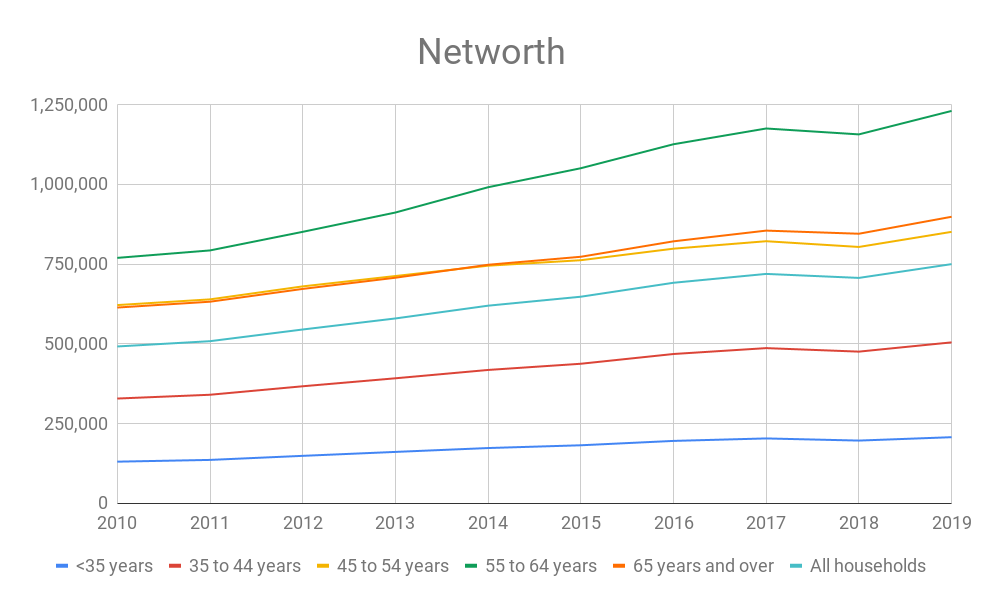

This is the second post in a series of six that walks through a theoretical exercise of coaching the “Average Canadian Household” to improve their financial situation. In the first post, we did a deep dive in to the Average Canadian Household’s finances – looking at their income, expenses, and net worth.

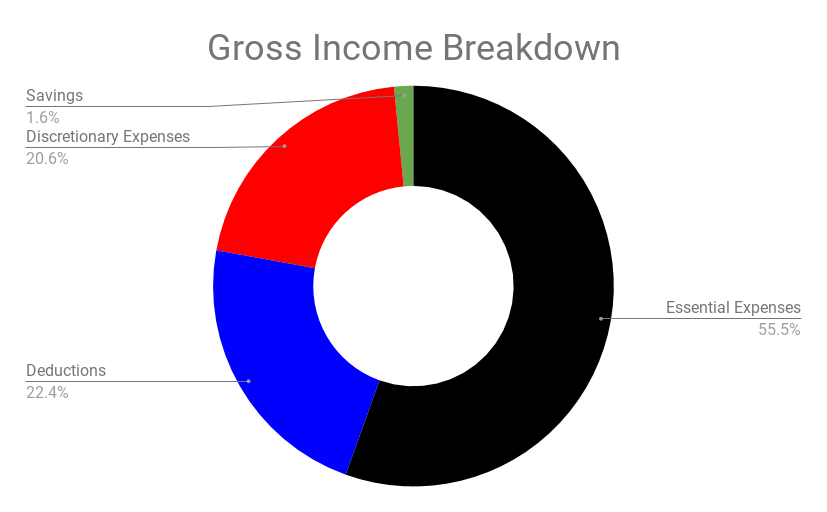

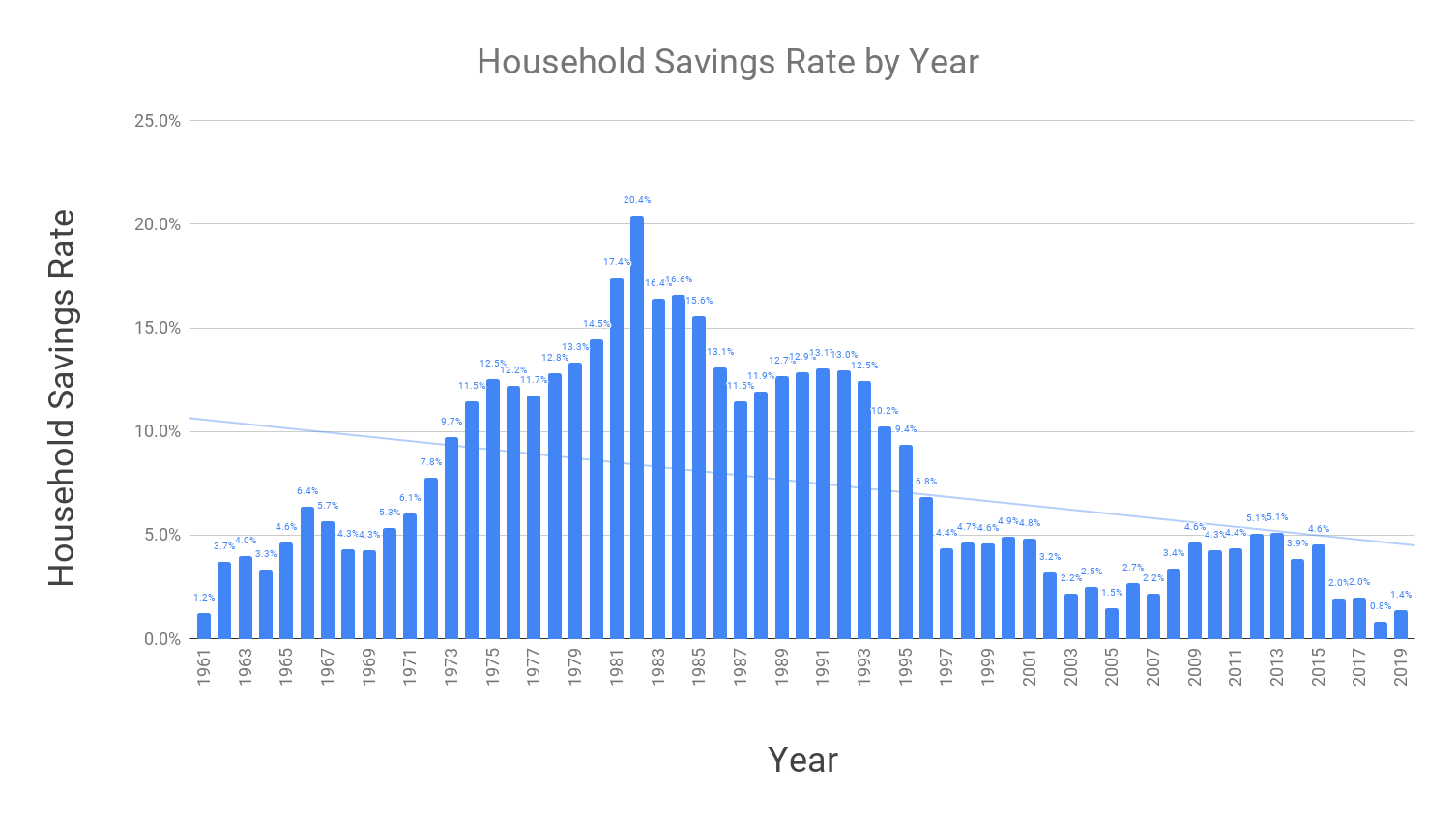

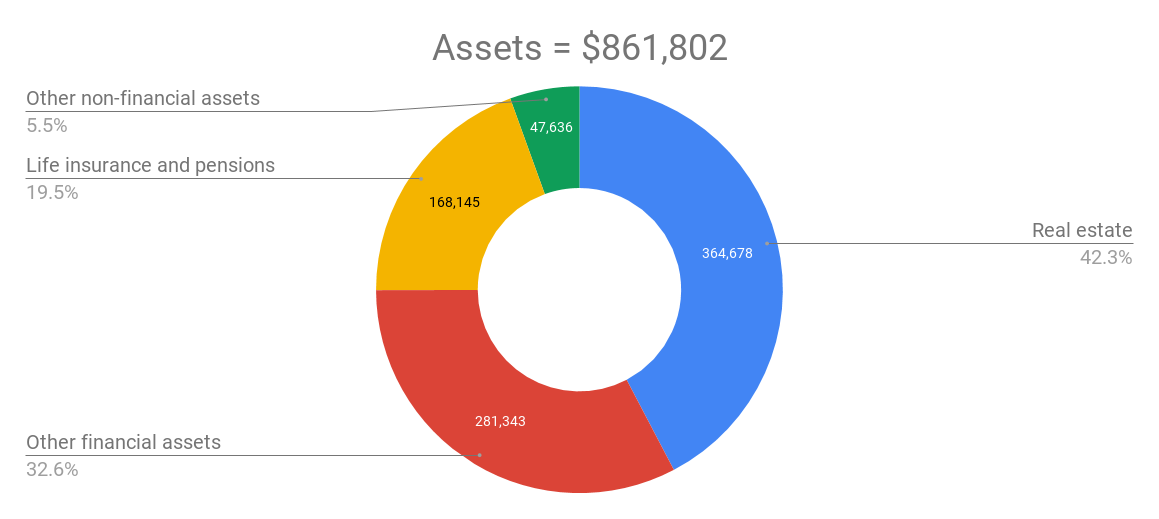

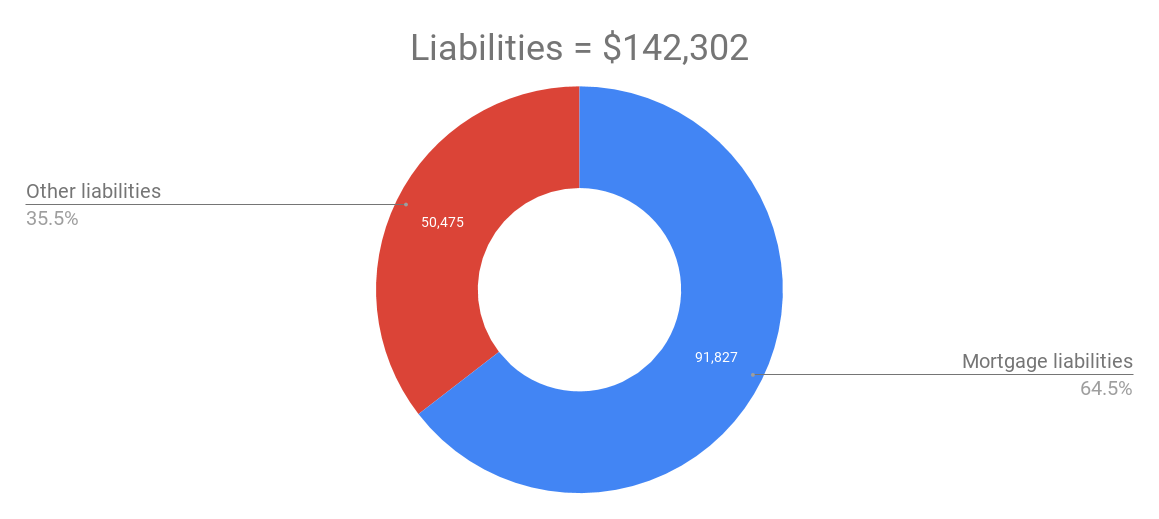

In my coaching program, once we obtain some data from tracking the client’s income and expenses (essential and discretionary), we work together to figure out where we can focus improvements in their financial situation, generally prioritizing changes that are likely to to have the greatest impact. In this post, let’s deep dive into the Average Canadian Household’s essential (vs. discretionary) expenses. Why start with essential expenses? Looking at the two donut charts below, “Essential Expenses” is 55.5% of the Average Canadian Household’s Gross Income (“gross” means before deductions such as Tax, Canada Pension Plan (“CPP”), and Employment Insurance (“EI”) contributions). At the Net Income level (only the amount that is left over after paying mandatory deductions), Essential Expenses is a whopping 71.5% of overall net income. This is why we will start here. When we think about “essential” expenses such as food, home, and vehicle, it is not surprising to overlook them as high potential saving areas since they are deemed necessities. However, how much you spend on housing, and what kind of car you drive will have a huge impact on how much you actually spend on essentials, which flows through to your savings rate and impacts the amount of time that you need to work to reach financial independence. The other thing I want to note and say again on this blog is that I’ve listed a bunch of ideas on how somebody may go about decreasing their expenses. That said, the whole list is not meant for everyone! Each individual and family has to decide what are important to them and then spend on those accordingly (aligning spending to values) – guilt free, as long as they consider the “time for money” and “money for stuff” tradeoffs that we make each day (often times, unconsciously).

What are Essential Expenses?

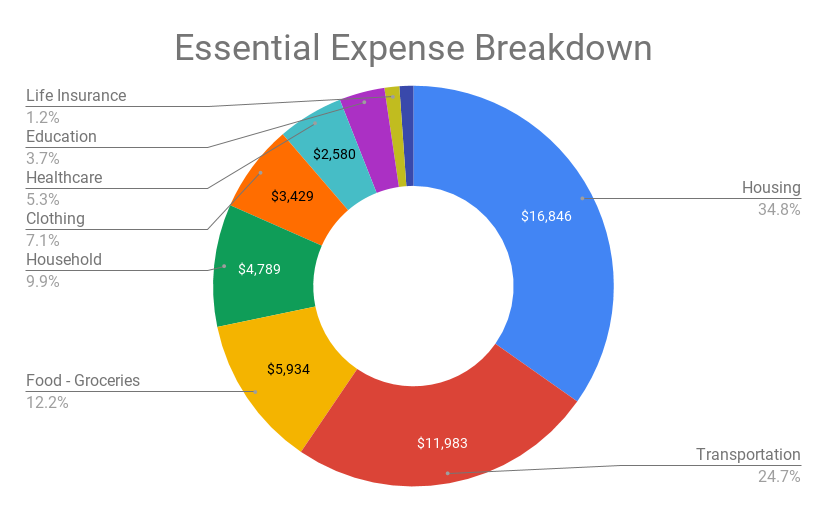

Now, let’s dive a bit deeper to see what really makes up “essential expenses” for the Average Canadian Household. Here is the breakdown for 2017:

Not surprisingly, the three largest essential expenses are Housing, Transportation, and Food. Generally, it is a good idea to start optimizing the largest expenses first since even marginal changes in these big categories can make a huge difference to the household bottom line (savings).

Housing

As mentioned in my last post, using data on the Average Canadian household isn’t perfect. In the housing category, it clearly shows that some Canadians own their own homes and some choose to rent. Obviously with an individual household it would only be one or the other, however, I will discuss both here.

Whether you decide to rent or buy, the key to minimizing costs in the housing category is to not buy or rent more than you need / can afford. There is a good quote that illustrates the benefit of this:

“If you will live like no one else, later you can live like no one else.”-Dave Ramsey

My personal situation is a good reflection of what this means. I very intentionally chose to live below my means throughout my 20’s. For housing, I chose to:

- Live with my parents during University rather than live on campus (I was fortunate to study in my hometown of Edmonton, AB)

- Live with my parents for a few years after graduating

- When I eventually moved out, I rented a place that was well below my means

Because I did the above, I was in the position in my early 30’s to buy a car with cash and a buy a house without a mortgage. I chose an unconventional approach initially and “lived like nobody else” so that I could “later live like no one else”. Certainly not saying that nobody else owns their car and house outright, however, it is rare for those in their early 30’s.

When choosing where to live, consider what you value more:

- Pay more to be closer to work and save time / money on your daily commute

- Pay less by living further away from work and spending a bit more time / money on your daily commute

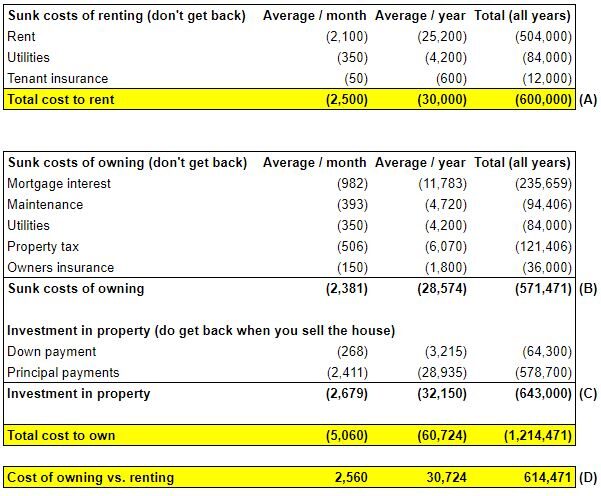

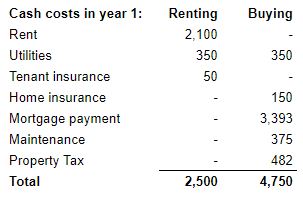

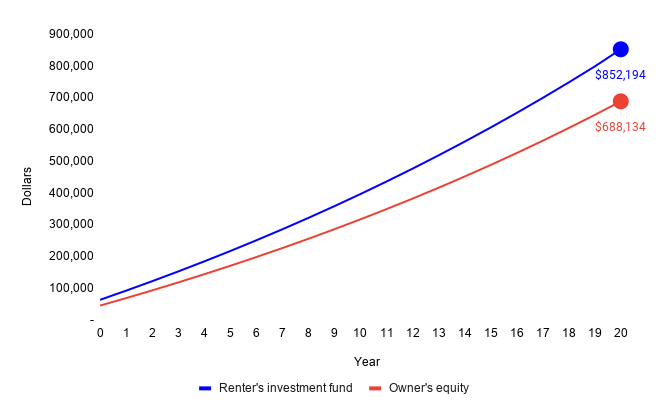

When comparing buying vs. renting from a financial standpoint, it is absolutely critical to consider sunk costs of ownership beyond just your mortgage payment (e.g. property tax, maintenance, insurance).

- For more on rent vs. buy, please see my rent vs. buy post.

When buying a property, consider the following:

- What percentage does your house make up in your investment portfolio? This was the key reason why I chose not to purchase a home in my 20’s – I didn’t want a single, illiquid asset to make up >100% of my networth. Now that I have accumulated more wealth, the purchase doesn’t look so big relative to my overall portfolio

- Make sure you do your due diligence so you are less likely to have surprises down the road. For example:

- If you are buying a home, I have detailed my due diligence process in this post

- If you are buying a condo, research the condo’s reserve fund and read the engineering studies that detail expected capital expenditures going forward – I have heard many horror stories about people who bought condos and later received “special assessments” for unexpected repairs to the buildings – sometimes to the tune of $20,000-$30,000 per unit

- It costs more than just the mortgage payment (my point above on sunk costs of ownership)

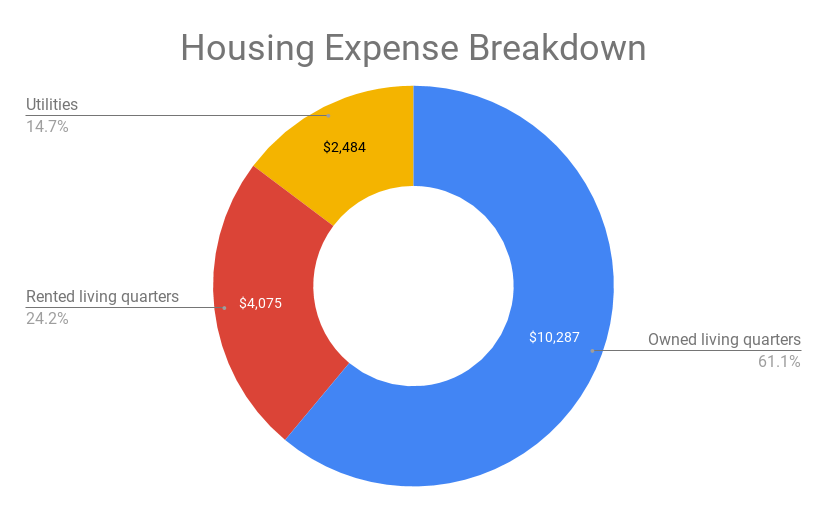

- As you can see below, when you own a home or condo, your mortgage payment is only part of the donut (54.8% on average). You must not forget about property taxes, other expenditures, homeowners’ insurance, repairs and maintenance and condo fees – they really add up!

When renting a property, consider the following:

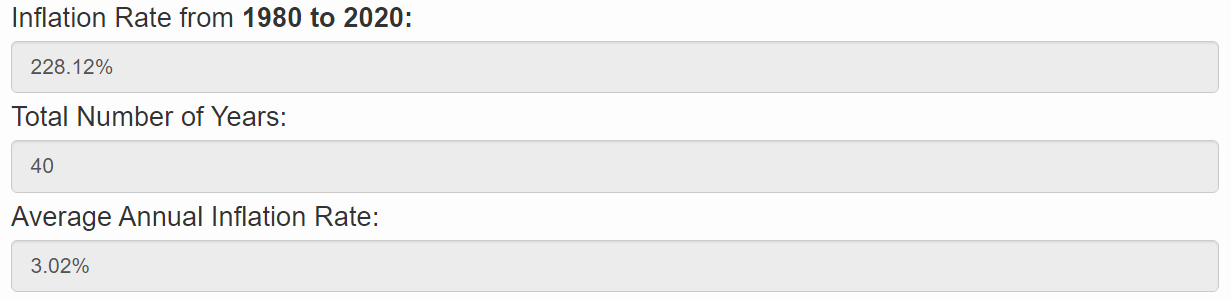

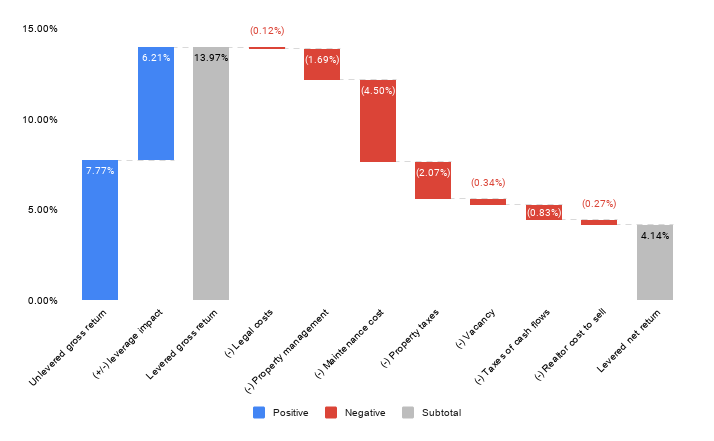

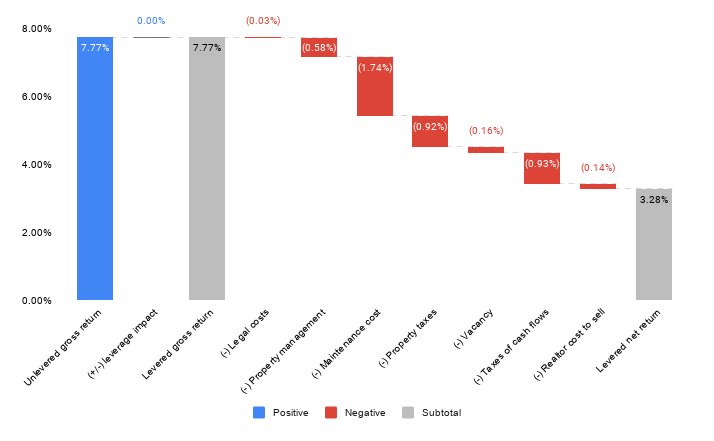

- To evaluate whether you are getting a good deal, think of the rental from the landlord’s perspective by calculating the rate of return they are earning on their investment. To do this:

- Take your gross monthly rent and multiply by 12 to arrive at your annual gross rent

- Figure out the property value – generally this can be easily found using city property value assessment maps online or by looking at comparable properties on a real estate search website like realtor.ca

- Take your annual gross rent and divide it by the property value to get a percentage. This percentage is the gross rate of return that the landlord is getting (before expenses). To get a net return, you can decrease the numerator by property taxes (can usually be found online), maintenance expenses or condo fees (can be estimated or found online), and insurance.

- If the return is sufficiently high and you plan to stay in that location for a significant period of time (5-10 years or more), then you may want to consider buying

Live alone or live with others

- One way to decrease your housing expense is to live with others. This isn’t for everyone and some people value their independence more than the cost and/or income associated with having a roommate or tenant. There are a few ways to do this:

- Live with a roommate and share the costs for a place – for example, it is generally cheaper for 2 people to share the costs for a 2 bedroom property vs. 1 person having a 1 bedroom property

- Rent out part of your principal residence (e.g. bedroom, basement, etc.) – some people call this “house hacking”

- I’ve heard of some people being able to rent out their basement and the rental income from their tenant cover their entire mortgage

- Others take this to the next level and buy a multi-bedroom house or a multi-unit residential complex and rent out rooms or units – in some cases, the owner was able to completely offset their own living expenses and bring in additional income (effectively negative housing costs!)

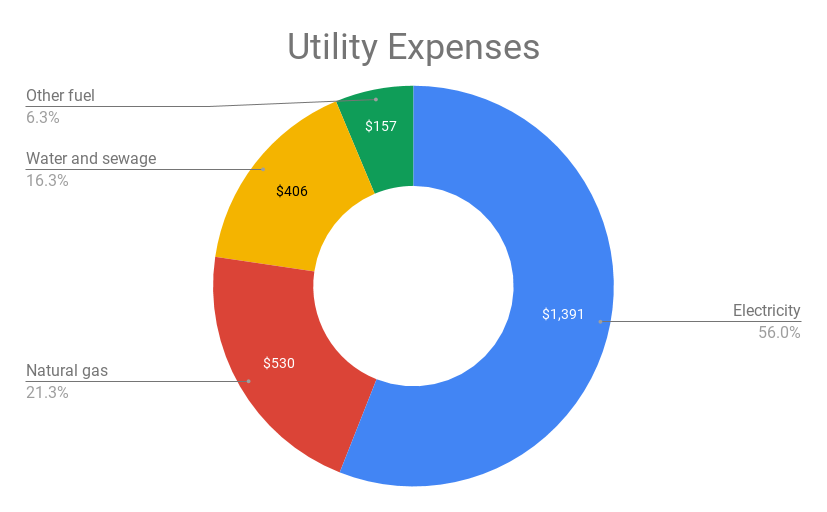

Utilities

According to Statistics Canada data, the Average Canadian Household spends ~$2,484 on utilities each year. From a house perspective this seems a bit on low, however, don’t forget that the “average” in the data includes not only houses but also rented or owned apartments and condos. Some utilities in this case would likely be included within the monthly rent and condo fees. My view on utilities is that if you can decrease your use of electricity, natural gas, and water without negatively impacting your life, why wouldn’t you! There is a double benefit to your bank account and the environment from doing so. Here’s the breakdown of the average utility spend per year:

I started putting down various ideas to reduce utility usage / increase efficiency and plan to write a whole separate post about that. For now, check out the EPCOR website for some great efficiency tips that can save you money and the environment: https://www.epcor.com/learn/efficiency-conservation/Pages/default.aspx

Transportation

The average Canadian household spends $12,707 on transportation each year – that is over $1,000 a month just to get around!

Here’s the breakdown:

Vehicle Operations

- Similar to house ownership costing more than just the mortgage payment (e.g. property taxes, maintenance, insurance, etc.) the cost to keep a car on the road for the Average Canadian Household actually exceeds the average cost of the car itself! Let’s break it down further:

A few ideas to optimize vehicle operation expenses:

- Gas

- Drive a more fuel efficient vehicle

- Use an app like Gas Buddy to optimize fuel costs – be careful about spending too much time on this since it usually isn’t worth your time (or gas) to drive across town to save a few cents per litre on a 50 litre tank. I fill up at Costco only when I’m there – I never make a special trip

- Drive less

- Try to plan where you need to go to minimize driving

- Try cycling or walking to destinations that are close to home – good for your health too!

- Insurance

- Get quotes from multiple companies

- Bundle your car insurance with your home or tenant insurance to get a discount

- Maintenance and repairs

- Perform scheduled preventative maintenance on your vehicle so that you lessen the chance of larger things coming up (e.g. regular oil changes, etc.)

- When you do need major work done, shop around – I like to do this in an efficient manner by sending the same e-mail to several shops requesting a quote for the work that I need done

- Registration fees

- No getting around these unfortunately

- Tires, batteries, and other supplies

- Shop around for deals

- I ended up getting tires at Costco since they were high quality and good value – Costco also ended up being WAY cheaper than other shops for the semi-annual switchover (in Canada, we have winter tires for the ice/snow and summer tires)

- Parking

- Try to park further away – save a couple bucks and get some exercise

- Licensing

- No getting around this unfortunately

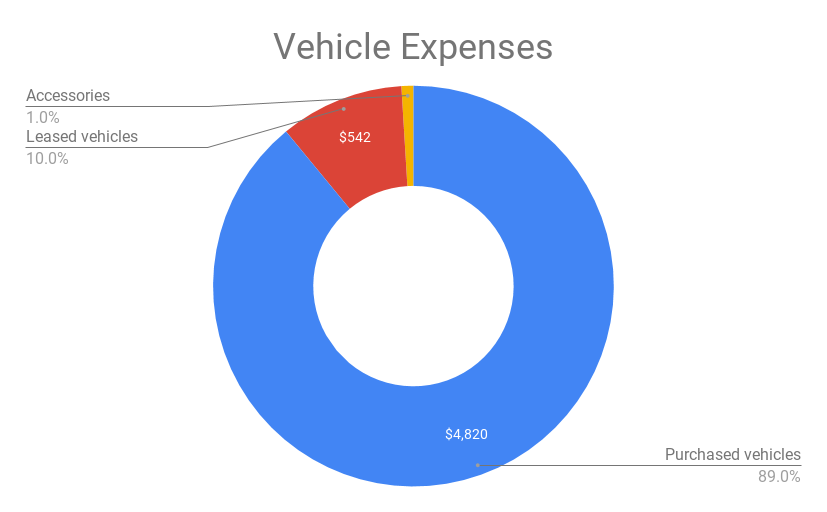

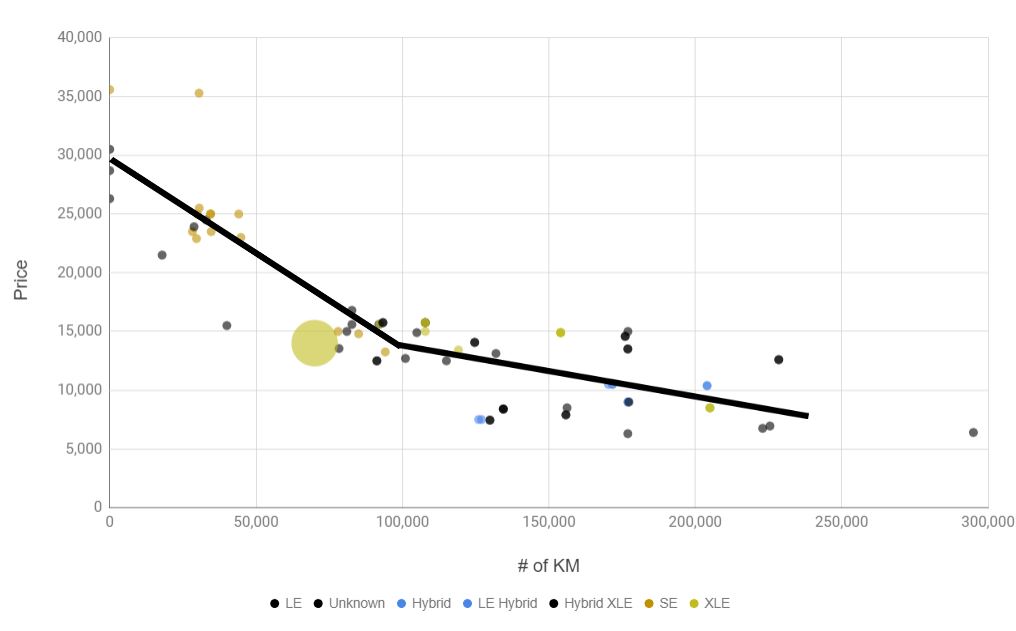

Vehicles themselves

- Looks like most people in Canada purchase their vehicles, however, some do lease

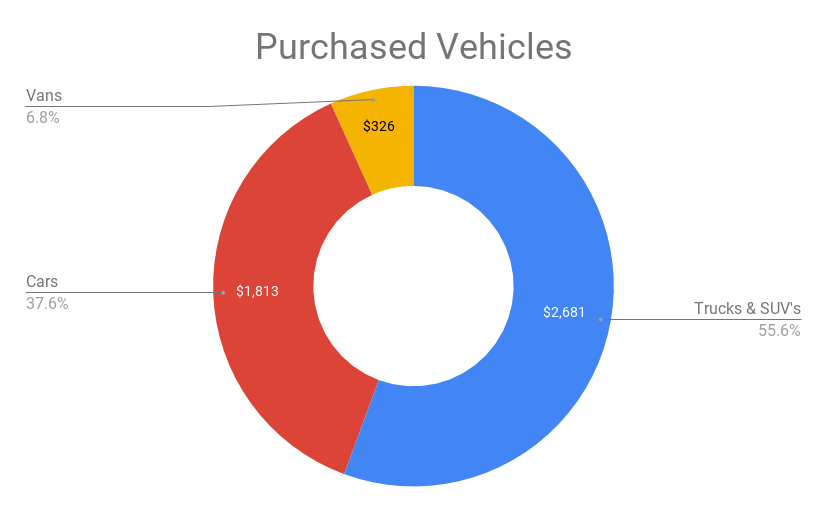

- Purchased vehicles – here is the breakdown of average annual expense by vehicle type. My advice here is to try to buy what you need. Maybe you don’t need a Ford F-350 if you are just picking up groceries once a week from the store (I know, not really an Albertan thing to say). Also, if it is possible for a family to get away with only having one car, it can lead to very significant savings (obviously this is a tradeoff though, and if it really decreases your quality of life having only one vehicle in the household, it may not be worth it)

- Trucks & SUV’s

- I’m from Alberta and with the number of trucks I see on the road, it doesn’t surprise me to see that this category is #1 (exceeding cars and vans on a combined basis)

- In my experience, I find that trucks and SUV’s are generally more expensive than cars – not only during the initial purchase but from an operational cost perspective (since they aren’t as fuel efficient)

- Cars

- My family of four grew up having 4-door sedans for the most part so I ended up buying a 4-door sedan. People say that you “need” a van or an SUV for a small family, however, so far it has been working out great for us. Let’s see what happens when we have two kids – maybe I’ll change my mind?

- Trucks & SUV’s

- Leased vehicles

- I’ve heard some people make the case for leased vehicles. I guess if having a very new vehicle is something you value and you don’t drive a lot (able to stay within the km restrictions and not have to pay too much in overage charges), maybe this does make sense for you.

- Rent

- Don’t forget – you can always rent a vehicle if you don’t need it very frequently. Maybe don’t buy a Yukon XL if you only need the extra space once a year for a trip to the mountains – just buy something less expensive and more fuel efficient for everyday use and rent that SUV for your annual mountain trip

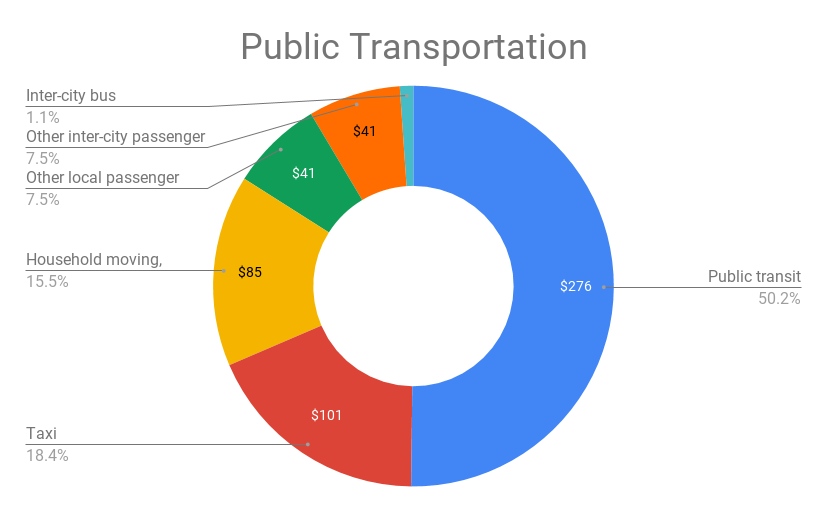

Public Transportation

- Public transit

- The fact that the Average Canadian Household spends only $276 per year on public transit suggests that public transit is underutilized

- Taxi / Other local passenger

- Consider ride share services like Uber / Lyft to save cash on local passenger travel

- Household moving

- I’ve always moved without hiring help. That said, I’ve only moved 3 times in my life. My wife has declared that we will be hiring professional movers for our move to the house – she has moved 14 times so I guess that is fair.

Please see my related posts on ideas to reduce transportation expenses and buying a used car.

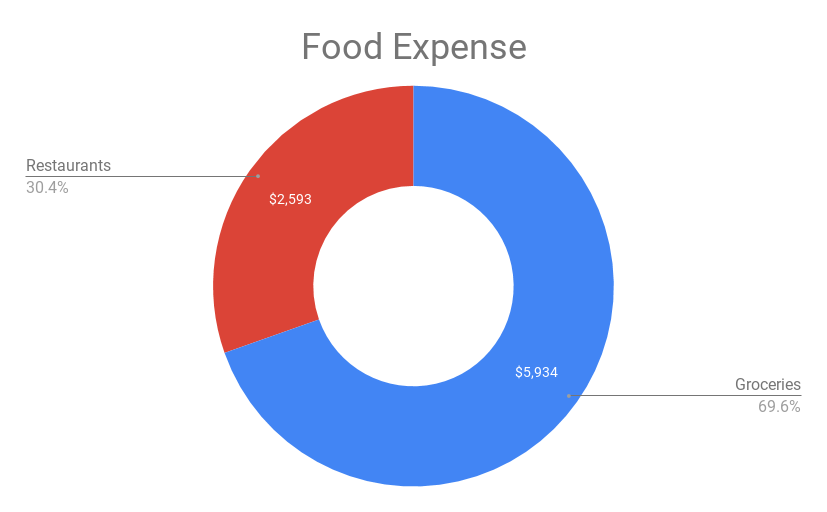

Food – Groceries & Household Items

We will talk about “Restaurants” in the next post on Discretionary Expenses but just so you know, here is the break down between Groceries and Eating out

Groceries

Some ideas to optimize:

- Meal plan – plan your meals in advance to minimize wasted ingredients and the need to run back to the grocery store to pick up a missing ingredient

- Take advantage of quantity discounts for non-perishables – a Costco membership has a pretty short payback period for a regular household

- I’m all for spending on groceries since I get a lot of value and enjoyment out of high quality, home cooked, nutritious and delicious meals

Other Essential Spending

- Rather than going into too much detail on the other essential categories (household, clothing, healthcare, education, life insurance), I’ll give some general tips here and write separate posts in the future going into more detail on how you can potentially save money in these categories:

- Household / Clothing

- Buy quality products that will last longer rather than cheap products that will have to be replaced regularly – this is also more sustainable for the environment

- My go-to example here is hiking boots. I paid $350 for a good pair of hiking boots because I know that they will last me 10+ years – I will get a lot of use out of them, and I value the comfort (waterproof and blister free) over price

- Take care of the things you buy (preventative maintenance)

- Think carefully about what you add to your household – we all have a lot of things we don’t even use that just take up space and will eventually take energy to donate / sell / dispose

- I was watching a show on minimalism the other day and really liked the minimalist approach to building a wardrobe. The minimalist featured said that every piece of clothing that he owned was his favourite. So rather than having 100 shirts, he might have 5 but they are all his favourites

- Buy in larger quantities to get quantity discounts (e.g. Costco)

- Buy on sale (e.g. past season apparels)

- Buy quality products that will last longer rather than cheap products that will have to be replaced regularly – this is also more sustainable for the environment

- Healthcare

- Compared to our friends south of the border, healthcare is less of a financial consideration for us Canadians due to our public healthcare system (although we certainly still pay for it through taxes!)

- For anything that is not covered (e.g. prescription medication, dentistry, etc.), if you have a work plan, get familiar with it

- If you don’t have a work plan, weigh the costs/benefits of signing up for a healthcare and/or dental insurance plan

- Education

- Save for your children’s education using a Registered Education Savings Plan (RESP)

- Encourage your kids to get good grades in high school and college and maximize extra curricular activities – this sets them up well to apply for scholarships and looks great on resume!

- I may be biased, but I am a big believer of staying local for your college / university education if you can. You can save a significant amount of money on living expenses by living at home, and not to mention out-of-state tuition for some countries

- If you want to go to an Ivy League school, consider doing your undergraduate studies locally and then going to a more prestigious school for your Master’s degree (if you choose to do one)

- Life insurance

- I am a fan of term insurance instead of whole life as I figure that my need for life insurance will decrease as my networth increases. I plan on writing a dedicated post on insurance to detail my thoughts and analysis on the subject soon

- Childcare

- This category was minor for the Average Canadian Household (it wasn’t even big enough to justify a label on the donut chart on Essential Expenses at the beginning of the post). This is likely due to the fact that childcare is only applicable to the subset of Canadian households that have kids. Furthermore, it is only applicable to those who choose to put their kids in childcare and whose kids are of the age that they need childcare. That said, it is a major expense for the small subset of Canadians who have young kids and require childcare! Another thing that this expense category ignores is those parents who decide to decrease their work down to part time or take time off completely to raise their children. The opportunity cost of those parents not working is definitely not reflected in the numbers and could very well be the largest “expense” of all

- Ideas to decrease childcare expense:

- Look at less expensive options like dayhomes

- Share a nanny with a friend

- Baby sitter swap – if you choose to work part time or not at all, take turns with a friend to care for your child and your friend’s at the same time

- Household / Clothing

I hope this gave you some helpful takeaways on how to decrease your essential expenses. We will shift gears and talk about Discretionary Expenses (if essential expenses are “the needs”, then discretionary expenses are “the wants”) in the next post.

If you are interested in my Financial Coaching Program, get more information on the program here and sign up for your free consultation.

Fun fact: I took this picture at the top of Sulphur Mountain in Banff the day I proposed to my wife. She passed the challenge of climbing to the top (no gondola allowed), so she was rewarded with a ring. Now she has to put up with me for the rest of her life!

Fun fact: I took this picture at the top of Sulphur Mountain in Banff the day I proposed to my wife. She passed the challenge of climbing to the top (no gondola allowed), so she was rewarded with a ring. Now she has to put up with me for the rest of her life!

If my life were a table, these would be the four legs. If one leg breaks, the table falls over. To make sure that my table / life doesn’t fall over, I set goals based on these categories and track my progress to ensure that I am maintaining balance in my life. If I were just to focus on the accumulation of wealth at the detriment of my health, love, and happiness, what would be the point? Life needs to be more than working for the weekends. You need to consciously set aside time for the big things in your life that are important to you. I hear so many people say that they are “too busy” for this or that. The truth is, if something is important, you can make time for it. Let’s run some quick numbers on this:

If my life were a table, these would be the four legs. If one leg breaks, the table falls over. To make sure that my table / life doesn’t fall over, I set goals based on these categories and track my progress to ensure that I am maintaining balance in my life. If I were just to focus on the accumulation of wealth at the detriment of my health, love, and happiness, what would be the point? Life needs to be more than working for the weekends. You need to consciously set aside time for the big things in your life that are important to you. I hear so many people say that they are “too busy” for this or that. The truth is, if something is important, you can make time for it. Let’s run some quick numbers on this: