Part 4: Aligning Earnings with Values

This is the fourth post in a series of six that walks through a theoretical exercise of me financially coaching the Average Canadian Household (as defined by Statistics Canada data) to see how we could improve their financial situation.

In the first post, we did a deep dive into the Average Canadian Household’s finances, looking at their income, expenses, and net worth.

In the second post, we did a deep dive into the Average Canadian Household’s essential expenses.

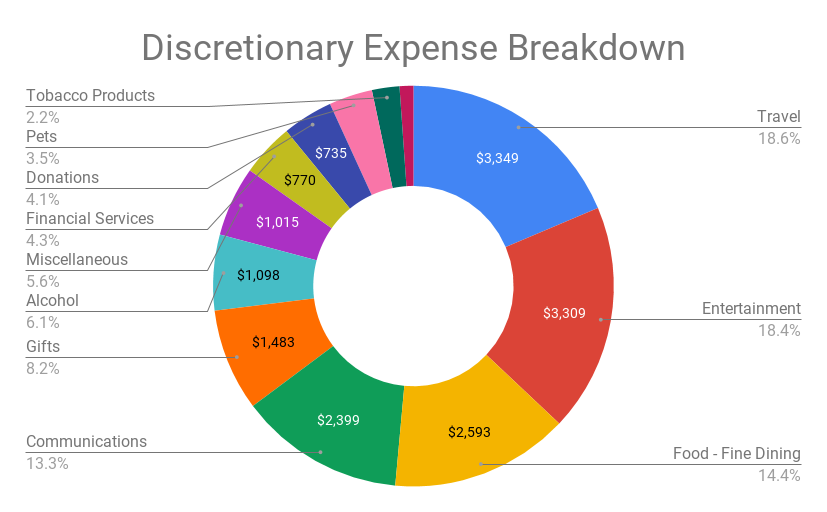

In the third post, we did a deep dive in to the Average Canadian Household’s discretionary expenses.

This post we will talk about aligning earnings with your values. What do I mean by this? I want everyone to understand that they are in control of how much they earn and they should adjust how much they earn based on what kind of life they want to live, how fast they want to reach financial independence, and what kind of balance they want to have along the way. It’s also important to point out that there are several ways to increase your employment income and/or earn money outside of traditional paid employment.

If after going through the first three posts of this series, you feel that you can’t cut expenses anymore without depriving yourself or decreasing your quality of life, you may not have a spending problem. Rather, you may have an earning problem. If this is the case, you may want to spend some time thinking about how you can increase your income to create a larger gap between income and expenses, thus saving more. As mentioned at the end of the last post, I view cutting expenses as “playing defense” and earning more as “playing offence”. Unlike expenses where you can only cut so much without decreasing your quality of life and/or being deprived, there is no upper limit on the amount of money you can earn. Let’s talk about a few ways that you can earn more.

Eliminate limiting beliefs!

- This is extremely important. I feel that a lot of people limit the amount of money that they earn by having limiting beliefs (they don’t believe that they are capable of earning more). Examples of limiting beliefs are:

- I’m not smart enough to do that

- I’m not cut out to be a manager

- I could never earn more than $100,000 a year

- If you have limiting beliefs, it is important to work on disproving limiting beliefs and replacing them with empowering beliefs

Take ownership of your current situation

“You are where you are and what you are because of yourself. Everything you are today -or ever will be in the future – is up to you. Your life today is the sum total of your choices, decisions and actions up to this point. You can create your own future by changing your behaviors. You can make new choices and decisions that are more consistent with the person you want to be and the things you want to accomplish with your life” – Brian Tracy

- It’s so easy to shift the blame to others when you are not where you want to be (either financially, or in other parts of your life). Maybe you think your boss is a horrible person and it’s their fault you don’t make more money. The reality is that you decide where you work and if you’re not happy, you can leave

- If you aren’t where you want to be, invest time and money to improve your situation. This may mean making some personal sacrifices. For example, maybe you spend time studying or researching new jobs or ways to earn more money rather than watching TV at night (don’t worry, you can add the TV back when you are where you want to be!)

Traditional employment

- How can you earn more in traditional employment? Make yourself more valuable to your company. There is a good book called the “Go-Giver” that illustrates two principles that apply here:

- The law of value – your true worth is determined by how much more you give in value than you take in payment

- You are in control of the value that you produce for your company – you can make yourself more valuable to the company you work for by increasing your skills that are relevant to your job (e.g. take continuing education courses that can make you a more valuable employee, or find a mentor in your company that is in a position where you want to be so they can help you get there). The more valuable you become, the harder it is to replace you and the more an employer will be willing to pay you

- The law of compensation – your income is determined by how many people you serve and how well you serve them

- If you really feel stuck (with limited upside to compensation) and/or don’t enjoy working in your current company / team / field / industry, consider whether changing companies or taking a career pivot makes sense. Maybe take some night classes on the side to try to switch to something else?

Earning money outside traditional paid employment

- Side hustle – there are various levels of “side hustles” that anyone can do to make money aside from traditional employment (or instead of traditional employment)

- Entrepreneurship – start your own business!

- This can either be a full-time endeavor or “on the side”. It’s not for everyone since starting a business from scratch takes a lot of hard work and dedication

- My advice to somebody who wants to start a business is to find their

“Ikigai”. This is what led me to start this website and a financial coaching / guest speaking business

- What the heck is Ikigai?

- Ikigai is a Japanese concept that means “a reason for being”. The word refers to having a direction or purpose in life, that which makes one’s life worthwhile, and towards which an individual takes spontaneous and willing actions giving them satisfaction and a sense of meaning to life. This colourful diagram sums it up quite nicely:

- If you find a business idea that aligns with your Ikigai (something you love doing, something that you are good at, something the world needs, and something that you can be paid for), it won’t feel like work at all

- Work on the side – if being an entrepreneur doesn’t run in your veins, you can always do some work on the side, trading your time for money alongside or instead of traditional employment. Generally the easiest place to start is where you already have experience. Examples of this would be an accountant who does tax returns on the side, a mechanic who works on cars on the side, or a roofer that does some other roofing work outside of work hours

- Gig economy – there are all sorts of “gig economy” jobs (“gigs”) where you can make money from the comfort of your home or your car and have an extremely flexible work schedule. Examples of this:

- Driving, or delivering food (e.g. Uber, Lyft, Uber Eats, Skip the Dishes, etc.)

- Turo – renting out your car

- Airbnb – renting out part or all of your home

- Freelancing – check out Fiverr or Upwork

- Rover – dog sitting / walking

- Investment income – once your start to accumulate an investment portfolio, your portfolio can start to work for you, each dollar acting as one of your “employees”. The great thing about these dollar employees is that they will work round the clock to earn money for their keeper. As you portfolio matures, these dollar employees gradually take over, allowing you to work less and eventually not at all (the point at which your portfolio is sufficient to cover all of your expenses, i.e. financial independence)

- Public investments – traditional asset classes such as stocks, bonds, guaranteed investment certificates (including products that aggregate these investments such as exchange traded funds and mutual funds)

- Private investments – other asset classes such as real estate, private businesses, private lending, timberland, farmland, etc.

Working too much?

- Although most people are probably in the “not enough money and want more” camp, there are others that have plenty of money but may be working so much that work has completely taken over their lives and they don’t have balance in their life

- I’ve personally heard many stories of people who are paid very well (e.g. investment bankers, lawyers) but fail to be happy. If you feel this might be you, I encourage you to read the story below about a Mexican fisherman. Take time to step back and think about why you are working so hard and what you are ultimately trying to achieve. The key message here is that sometimes you can achieve a very good quality of life with less

The Mexican Fisherman:

An American investment banker was at the pier of a small coastal Mexican village when a small boat with just one fisherman docked. Inside the small boat were several large yellowfin tuna. The American complimented the Mexican on the quality of his fish and asked how long it took to catch them.

The Mexican replied, “only a little while”. The American then asked why didn’t he stay out longer and catch more fish? The Mexican said he had enough to support his family’s immediate needs. The American then asked, “but what do you do with the rest of your time?”

The Mexican fisherman said, “I sleep late, fish a little, play with my children, take siestas with my wife, Maria, stroll into the village each evening where I sip wine, and play guitar with my amigos. I have a full and busy life.” The American scoffed, “I am a Harvard MBA and could help you. You should spend more time fishing and with the proceeds, buy a bigger boat. With the proceeds from the bigger boat, you could buy several boats, eventually you would have a fleet of fishing boats. Instead of selling your catch to a middleman you would sell directly to the processor, eventually opening your own cannery. You would control the product, processing, and distribution. You would need to leave this small coastal fishing village and move to Mexico City, then L.A. and eventually New York City, where you will run your expanding enterprise.”

The Mexican fisherman asked, “But, how long will this all take?”

To which the American replied, “15 to 20 years.”

“But what then?” asked the Mexican.

The American laughed and said, “That’s the best part. When the time is right you would announce an IPO and sell your company stock to the public and become very rich, you would make millions!”

“Millions – then what?”

The American said, “Then you would retire. Move to a small coastal fishing village where you would sleep late, fish a little, play with your kids, take siestas with your wife, stroll to the village in the evenings where you could sip wine and play your guitar with your amigos.”

Source: https://bemorewithless.com/the-story-of-the-mexican-fisherman/

I hope you all found this post encouraging. For those of you who are already able to save a significant portion of your earnings or are close to financial independence, maybe you don’t need to focus so much on earning more. Most people can benefit from the offensive strategy of earning more, whether that is from additional employment income, something on the side, or an entrepreneurial venture. This can allow you to increase your spending and/or increase your savings and decrease the amount of time to reach financial independence. I think everyone can benefit from taking a step back and evaluating your overall situation to ensure that you are happy where you are, and doing what you like doing. If not, you all have the power to change your situation for the better. Find your Ikigai!

Now that we have covered an overview of the Average Canadian Household finances, aligning essential expenses with values, aligning discretionary expenses with values, and earning more, in the next post, we will discuss constructing a debt-paydown and/or savings strategy.

If you are interested in my Financial Coaching Program, get more information on the program here and sign up for your free consultation.

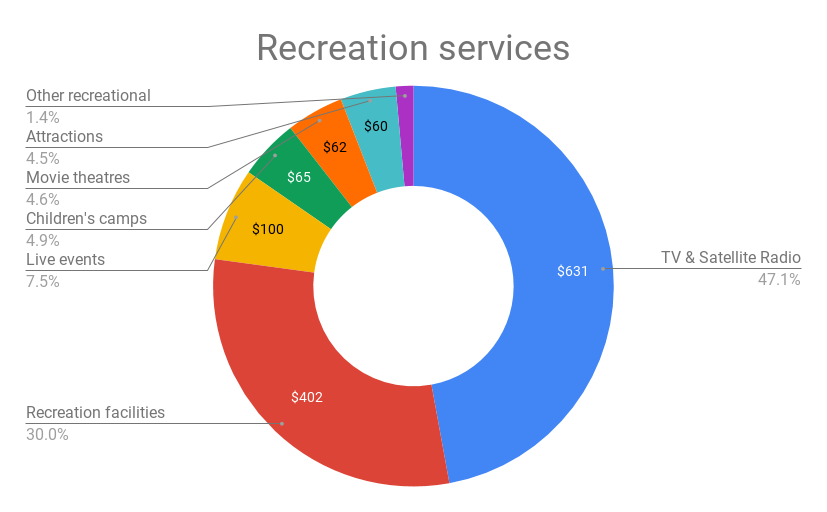

TV & satellite radio

TV & satellite radio