It’s hard to believe but my son is now 16 months old! I thought now would be a good time to look back and see how much we spent in the first year of parenthood (from just before he was born until his first birthday).

Before we get going, I’ll set the stage by being up front that we have not tried to fully optimize our child related expenses. Since we are further along in our financial independence journey, in most cases we have chosen the easy path as we put a very high value on our time and value convenience at this point in our lives, especially now with our little guy. There are other financial bloggers out there who have done a much better job of optimizing. Modern FImily for one, reported a total year 1 spend of $3,891 (with $2500 of that being for education) – https://modernfimily.com/heres-how-much-babys-first-year-cost/

Although I do track my income and expenses and review on a monthly basis, even I was a bit surprised of the aggregate cost of the first year. It really adds up! Let’s check it out:

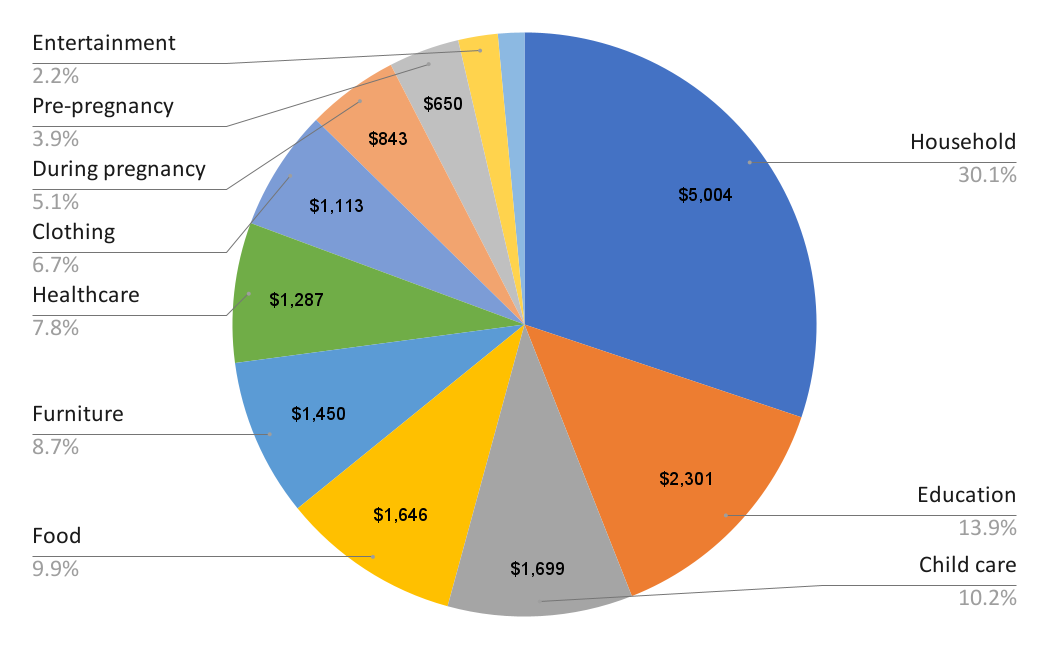

The grand total: $16,600

- Household ($5,004)

- This is the catch all category that covers all types of household expenses

- Individual items >$100

- Car seat #1 and stroller $419.97 – initially we bought a bucket car seat which clicked in to the car base and a stroller

- Car seat #2 $455.16 – once Parker was 10 or 11 months old, we upgraded to a much larger fixed car seat that stays in the car.

- Giant play pen $192.91

- Baby carrier $119.70

- Other material items:

- Diapers – I wasn’t organized enough to categorize diapers on their own but they are definitely a big part of the overall household category

- Baby wipes

- Disposable changing pad liners – we used these to decrease the amount of time washing the fabric change pad cover

- Breast pump

- Blender for to puree baby food

- Other: fabric change pad covers, waterproof change pad cover, washcloths, face towels, baby towels, swaddle blankets, diaper caddy organizer, wipes warmer/holder, pacifier clips for stroller, rain cover for stroller, play mat, haakaa pump, baby lounger, boppy pillow (since recalled due to safety reasons), toothbrush, body wash, back seat mirror for car, diaper genie and multiple refills, sippy cups, car seat head support, baby dish soap, baby laundry detergent, crib sheet, baby gate, splash mat for under high chair, nasal drops, baby k’tan, passport fee, camping chair, diaper bag, storage bowls for food, baby proofing cabinet locks, car window shades, night light, ice cube trays for pureed food, bottle drying rack, bibs, bottle brushes, spoon set, baby safe all purpose cleaner spray, bottles and corresponding nipples for various flow levels,

- Education ($2,301)

- We contribute $208.34 ($2,500 ÷ 12) to our son’s Registered Education Savings Plan

- Our son was born in November, but I set up his RESP in January so only reflected 11 months of contributions in 2021 (up to Parker’s first birthday)

- Childcare ($1,699)

- Our child care expenses were very minor for the year since my wife was on maternity leave for 12 months (so we didn’t require child care). This amount reflects the first month of child care plus 1 week given we put him in a week before my wife went back to work so he could get used to the new routine.

- We also placed deposits at two other day cares as back up options just in case.

- Fortunately for new parents in Alberta, it looks like the cost of child care is expected to decrease substantially: https://www.alberta.ca/federal-provincial-child-care-agreement.aspx

- Food ($1,646)

- Most of this cost (~$1,400) relates to infant formula

- We only broke out our son’s food expense from our grocery bill if it was a specialty item for him. That said, this number is probably understated a bit given he now eats what we eat.

- Furniture ($1,450)

- Crib $628.95 – we were able to use my crib initially (yes my crib from 30 years ago), however, had to upgrade to something shorter once our son was a bit older so that my wife could reach down in to the crib safely

- Nursing chair $545.99

- Dresser / change table $129.99

- Healthcare ($1,287)

- Since we live in Canada, most of our healthcare costs were included in our public health coverage (I’m definitely not going to say “free” as some people say given my marginal tax rate is close to 50%)

- We had a few doctors appointments and tests that were not covered since my wife did not become a permanent resident of Canada until part-way through her pregnancy.

- We engaged a lactation consultant to help my wife with breast feeding

- As far as equipment, we bought

- A breast pump for my wife

- Breast pads

- A thermometer to test baby’s temperature

- As far as medication and vitamins, we ended up purchasing:

- Clothing ($1,113)

- If it wasn’t for my mom, this category would definitely be much higher. She has bought most of our son’s clothes since birth. Thanks Mom!

- We saved money buy buying some used clothing initially and using hand me downs from friends and family.

- During Pregnancy ($843)

- Lactation consultant pre-birth

- Iron pills

- Prenatal / child birthing classes

- Private birthing session

- Etc

- Pre-Pregnancy ($650)

- Fertility lessons

- Ovulation kit

- Fish oil

- Pregnancy tests

- Entertainment ($363)

- We enrolled our boy in swimming lessons for four months. Initially he hated it, but after a few sessions he grew to love it and significantly increased his comfort in the water. We decided to take a bit of a break from this for now (during the winter given it is so cold here) and pick it back up in the spring/summer). We paid for premium lessons with smaller class sizes at a swim facility that is close to our house.

- Toys ($243)

- I feel a bit bad that the lowest expense category is toys! Fortunately our boy is not deprived from nice toys. Funny enough, my mom saved several of my toys from when I was a kid 30+ years ago. This saved us quite a bit of money and it was nice to see our son playing with the same toys that I played with as a kid. Our little guy also received a lot of toys as gifts during the first year of his life.

The hidden costs of raising a child / children:

- Although I have tried to be comprehensive in stating our cash expenses related to our new addition, there are two major key costs that are not reflected here:

- 1. Opportunity cost of my wife not working for one-year during her maternity leave

- 2. The cost of needing more space

- Wanting to grow our family, we ended up moving from an apartment to a house. This move materially increased our overall cost of living, however, was not entirely related to having kids as it was always the plan to eventually move to a house to have more indoor living space and a yard.

How we could have done better:

- Comparing our grand total for year 1 of $16,600 to Modern FImily’s grand total of $3,741, it is clear that we could have spent a lot less than we did. That said, as mentioned, we were intentional in our decisions and valued convenience over being 100% financially optimal

Recommendations for new parents:

- Get a water boiler!

- Having readily available pre-boiled water saved us hours (likely days!) along our journey as new parents

- Hopefully you can use this list as a reference of what you may or may not need as a new parent. Each family is different and expenses will vary widely depending on approach (financial optimization vs. higher cost / convenience)